COVID-19 disrupts battery materials and manufacture supply chains, but outlook remains strong

COVID-19 disrupts battery materials and manufacture supply chains, but outlook remains strong

The effects of the coronavirus global pandemic have rippled through many lives and have upended aspects of health care, transportation, and the economy in virtually every country. The energy materials and renewable generation and conversion mar- ket, which includes battery-powered electric vehicles, grid stor- age, and personal electronic devices, is no exception.

As businesses shut down worldwide, road traffic ground to a standstill, and the demand for electric automobiles plunged. Quarantines and stay-at-home orders barred workers from op- erating battery and automobile production facilities, shuttered mines and refineries, and froze shipments of manufactured goods. Economic uncertainty and mass layoffs have curtailed consumer spending and have driven down the demand for top-of-the-line mobile phones and tablets. These factors threaten the vitality of energy-storage materials and the long-term growth of renewable sources. Responses to this crisis, including government policies, emerging energy storage and manufacturing technologies, and persistence of the research community, will lay a significant imprint on whether the long-term effects of COVID-19 are miti- gated or exacerbated.

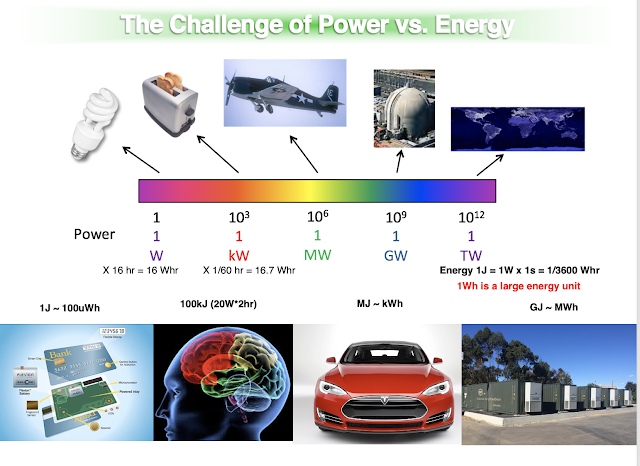

The demand for lithium-ion batteries (LIBs) is immense: Their market was pegged at USD$36.7 billion in 2019 and is projected to hit USD$129.3 billion by 2027. The ubiquity of LIBs stems from research-driven efficiency improvements and an ex- tensive worldwide manufacturing and distribution industry that, through improvements in scale and processing, has driven down battery prices by 87% in the last decade. Although the United States is one of the biggest consumers of LIBs, it only produces 12% of the annual 316 GWh of lithium cell manufacturing ca- pacity. China remains the largest manufacturer and accounts for 73% of annual LIB production.

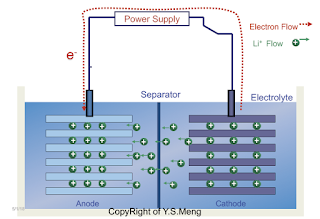

This disparity in manufacturing correlates with the constitu- ent critical elements that enable high performance in state-of- the-art LIBs. Lithium and cobalt serve key functions in battery cathodes and electrolytes. China dominates the production of rare-earth elements (63%) and, effectively, controls 80% of the global supply chain of these materials. While the Democratic Republic of Congo mines 70% of the world’s supply of cobalt, China holds major financial ownership. Australia produces 55% of the world’s lithium and exports the majority of it to China. Subsequently, the resulting supply chain stretches around the world and involves numerous production facilities, domestic and international freight transport networks through countless ports of entry, and thousands of workers. While lithium and cobalt elements are the most widely recognized vulnerable links in the LIB manufacturing process, the supply of graphite, which typically functions as the anode, is equally at risk. Its refinement into industrial-grade sheets and powders is also primarily centered in China. Furthermore, nickel and manganese, which also constitute critical components in battery assemblies, are reprocessed in only a few locations around the world.

Comments

Post a Comment